Top 15 Best Neobanks In India 2024

Table of content:

How about reducing the hassles of physical banking services? You heard it right!

With digitization, several payment service providers (PSPs) offer new-age banking solutions to customers through digital banking services. This is paving the way for the launch of neobanks.

In this blog, we will discuss what neobanks are and some top neobanks in India.

GetMega Rummy is an amazing platform that lets you play rummy with friends & family with real money. Sounds fun, isn't it? Download the GetMega rummy app now!.

What are Neobanks?

Neobank is a digital-only bank that operates digitally online using artificial intelligence & machine learning techniques, replenishing the pre-existing traditional banking services.

Neobanks offer a virtual banking experience providing all the banking services of physical banks with the help of mobile-only platforms.

Top 15 Neobanks in India.

Here is the list of neobanks in India that are also the best neobanks in the world.

1. Freo

Following its success with the credit-lending app MoneyTap, Freo has transitioned to the neo banking space offering multiple financial products and is recognized among the top neobanks in India.

Features:

- The modern digital savings account offers spending insights, goal-based savings, and a guided path to credit health.

- Help improve credit health while managing your expenses and saving for the future.

- On-demand access to credit (up to Rs. 5 lakhs).

- Offer Freo cards with features like auto-EMI & Pay Later. Freo neobank allows a group of users to split and settle a bill quickly.

2. Jupiter

Founded in 2019 by fintech veteran Jitendra Gupta, neobank Jupiter is one of the best neobanks in India.

Features:

- Tracking and managing finances are made simple and enjoyable.

- Jupiter neobank operates as an expense tracker, providing real-time insights into your spending habits.

- Jupiter does not necessitate you to keep a certain average balance.

- Jupiter provides a free debit card for a lifetime.

- Earn 1% assured cashback on every purchase made with Jupiter's smart debit card or every UPI transaction.

- 24×7 customer support.

3. PayZello

Founded in 2017 by Pruthiraj Rath, PayZello is one of the latest fintech neobanks that puts our finances at our fingertips.

Features:

- Banking that is both convenient and secure.

- Offers perks such as cashless payment, auto-debiting, and bill-splitting.

- We can set up multiple sub-accounts and have funds automatically deducted from our linked bank account to meet your savings goals.

- Updates our spending in real-time, allowing us to track and assess finances efficiently.

- No account opening charges or management fees.

4. Chqbook

Chqbook is the first neobank in India for small business owners like Merchants, Chemists, Kiranas, and all other sole proprietorship enterprises.

Features:

- Through its five pillars – khata, banking, lending, insurance, and rewards – this fintech neobank startup provides a wide range of advanced and highly interactive financial services to small and medium businesses (SMBs).

- Track customer credit and collect payments.

- Fast loan disbursal at best rates.

- Rewards on daily transactions.

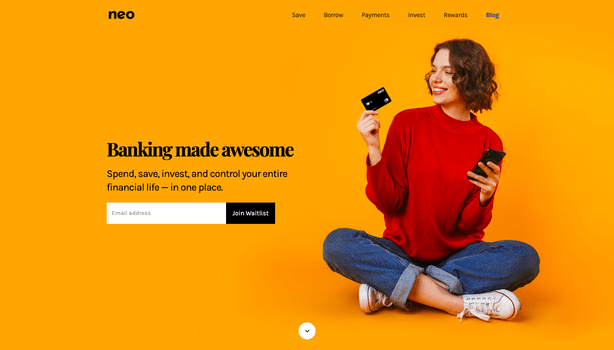

5. Neo-bank

Neo-bank is one of the trusted neobanks in India that uses intelligent algorithms to assist us in automating our finances to get the most out of our money.

Features:

- Offers rapid payment systems, intelligent insights, and savings tools.

- Helps make informed financial decisions.

- Improve our understanding of every expenditure and track it all in one place.

- Help customers and SMEs spend, save, invest, and manage their money more effectively and efficiently.

- There are no hidden fees or charges on financial transactions.

6. InstantPay

Founded in 2013 by Shailendra Agarwal, Instantpay neobank is the largest neobanks of all neobanks in India.

Features:

- Provides a full range of financial services to people and organizations of all sizes.

- Get a digital prepaid account or a full-fledged business current account in seconds and minutes, respectively.

- Provides a clear picture to track spending.

- Offers InstantPay Digi Kendra service for us to do basic banking, get insurance, and much more.

- It can be accessed on the Web, Mobile & API.

- Premium customer support round the clock, 365 days a year.

7. Fi Money

In partnership with an RBI-licensed Federal bank, neobank Fi Money is a money management platform that redefines the banking experience in India.

Features:

- It gives a high level of priority to keeping our data secure and confidential.

- Fi app is configured to automate every action, including fund transfers, p2p payments, bill payments, etc.

- Offers a Fi Debit card, spend insights, and tools to help grow money and earn rewards.

8. Niyo

Niyo is a leading fintech neobank of India that uses technology to simplify finance, making banking easier, smarter, and safer for us.

Features:

- Niyo neobank offers an instant 100% paperless zero balance account opening service.

- It is the first neobank in India to provide a 2-in-1 savings account and wealth management solution.

- Comes with the best interest rate of 7% on savings account balances.

- Zero forex markup lets us make transactions with international merchants without any additional fee.

- Enhanced security control.

9. Finin

Finin is a hyper-personalized neo-banking platform and the first full-fledged consumer neobank in India.

Features:

- Let us create a savings account in under 2 minutes with a minimum KYC.

- Offers VISA Finin debit card for online payments and transactions.

- Uses AI-powered analytics and insights to provide us with the save-spend data, bill payments, tracking refunds, and recommendations on the best practices.

10. FamPay

FamPay is the first Indian neobank for students, minors, and teens, which facilitates online and offline payments for them under the supervision of their parents.

Features:

- Provides a secure, numberless card co-branded with IDFC First Bank.

- Allows simple payments across multiple categories, such as OTT platforms, eCommerce, Food apps, and others.

- Two-factor authentication for all payments.

- Super safe and have no hidden charges.

- The support team is active 24x7.

11. North Loop

Next on the list of neobanks in India is North Loop, one of the world's top neobanks. It serves a global audience and provides banking and investment services.

Features:

- The app eliminates the difficulties associated with opening accounts in a new country, obtaining credit, and managing finances within India.

- Provides a wide range of business products and services, including Virtual Accounts, Invoicing, Cash Management, Expenses, Payment Gateway, Vendor Payments, and Payouts.

- Provides personalized, goal-based plans to assist individuals in saving and financially securing their future.

12. Fold

Fold is an upcoming neobank in India that strives to enhance customers' banking experience beyond imagination and provide outstanding banking services to them.

Features:

- Fast, robust, and transparent digital-only bank.

- Offers to exercise control over finances.

- Create daily, weekly, and monthly budgets to track and manage our spending and avoid overspending.

- Offers VISA-powered debit cards with which we can enjoy instant cashback on every transaction.

13. Mahila Money

Mahila Money, formerly known as Sheroes Money, is among the best neobanks in India that empower women and aspiring female entrepreneurs to be financially independent.

Features:

- Provides immediate access to wellness plans and credit to help our small or large business ventures take off.

- We can open bank accounts online within a few minutes.

- Provide financial advice and support to start the financial journey.

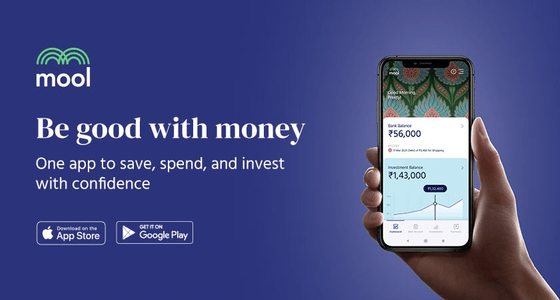

14. Mool

Mool is an innovative neobank in India that specializes in fund management, investment opportunities, and savings on the go.

Features:

- Let us open smart savings account without a minimum balance.

- Puts an auto-pilot on savings and investment.

- Uses curated innovative plans with personalized insights.

- Offers instant payments, contactless cards for purchases, and assists in credit score building as we transact.

15. OCareNeo

OCareNeo is the first neobank in India to integrate healthcare and banking services onto a single platform.

Features:

- Ensures a pleasant experience for both healthcare professionals and patients.

- Assist people in keeping their health in check while tactically growing their wealth.

- Offers scannable QR codes to instantly get one-tap access to medical history, medical reports, and e-insurance details.

- Provides virtual OCareNeo card to swipe and manage healthcare expenses

- Offers digital piggy banks for saving.

GetMega Rummy is an amazing platform that lets you play rummy with friends & family with real money. Sounds fun, isn't it? Download the GetMega rummy app now!.